Explore the scope of EVs in India, government schemes, and the growing opportunities in the EV industry and charging station sectors.

Table of Contents

Opportunities in EV Industry in India| Scope of EVs in India

India, the third-largest car market in the world, plays an important role in the global auto industry, adding about 7% to its GDP. The rise of electric vehicles (EVs) is changing this space quickly, as the world moves toward cleaner transportation. In 2024, EVs made up 7.5% of all vehicles sold in India, with electric two-wheelers making up 60% of those EV sales. Government programs like FAME and the PLI scheme, along with new battery technologies, are helping India move toward its goal of increasing EV use and shaping the future of transportation.

Present Scenario of adoption of EV in India

India’s Expanding EV Market:

In 2024–25, electric vehicles reached a 7.5% share of total vehicle sales in India, thanks to growing consumer awareness and government support.

However, the country still trails behind global leaders like China, where over half of all new cars sold in 2024 were electric.

Electric Two-Wheelers Take the Lead:

Electric two-wheelers make up 60% of India’s EV sales, driven by their lower cost and suitability for city travel.

This segment continues to grow as more people look for budget-friendly and environmentally friendly transport options.

EVs in Public Transport:

Electrifying public transport is a major goal, with the government aiming to introduce 14,000 electric buses by 2026.

States like Telangana and Karnataka are expanding their e-bus fleets to improve urban transport and reduce emissions.

Government Policies Supporting EV Adoption:

The FAME II program, with a budget of ₹10,000 crore, has helped speed up EV adoption across different categories.

By offering benefits to both buyers and producers, the scheme has especially boosted sales of electric two- and three-wheelers.

Battery Technology and Local Production:

India is working on building its own battery production capabilities, focusing on Lithium Iron Phosphate (LFP) batteries.

This effort aims to cut down import dependence, strengthen energy security, and lower EV prices.

Goals for 2030:

India is targeting 80% EV use in two- and three-wheelers, 40% in buses, and 30% in private vehicles by 2030.

These goals are supported by programs like the PLI scheme, which encourages more local manufacturing.

Also Read Sports Current Affairs 2025

Challenges in the Growth of EV Adoption in India

High Upfront Cost of EVs:

Electric vehicles are still 20–30% more expensive than traditional petrol or diesel vehicles, making them less affordable for many buyers.

Although the government offers subsidies and lower GST rates, these measures haven’t been enough to make EVs accessible for low-income groups.

Also, there are fewer budget-friendly EV models compared to conventional vehicles, limiting choices for buyers.

Lack of Charging Infrastructure:

India currently has just one public charging station for every 135 EVs, far behind the global average of one station for every 6 to 20 EVs.

To reach the goal of 3.9 million stations by 2030, the charging network needs to grow quickly.

However, building charging stations is costly, and in some regions, an unstable power supply affects their reliability.

Another issue is the lack of standardized charging systems, as different EV makers use various connectors, making it harder to expand the network smoothly.

Dependence on Battery Imports:

India relies on imports for more than 90% of its lithium-ion batteries, which exposes the EV industry to international supply chain risks.

While efforts to boost local battery production are underway, they haven’t yet made a big impact in reducing this dependence.

Uncertainty in Regulations and Policies:

Frequent changes in EV policies, such as switching from FAME II to the PM eDrive scheme, create confusion for both buyers and manufacturers.

To build trust and ensure long-term growth, the industry needs consistent and stable policy guidelines.

Concerns About Range and Battery Life:

Many people worry that EVs can’t travel far on a single charge, leading to what’s known as “range anxiety.”

Although battery performance has improved, fast-charging options are still limited, which discourages some from making the switch to EVs.

Low Awareness and Financial Challenges:

A lack of knowledge about EV benefits and technology slows down adoption among the general public.

In addition, difficulties in getting loans and the perception of low resale value make EVs less attractive to many potential buyers.

Initiatives to promote the adoption of EVs

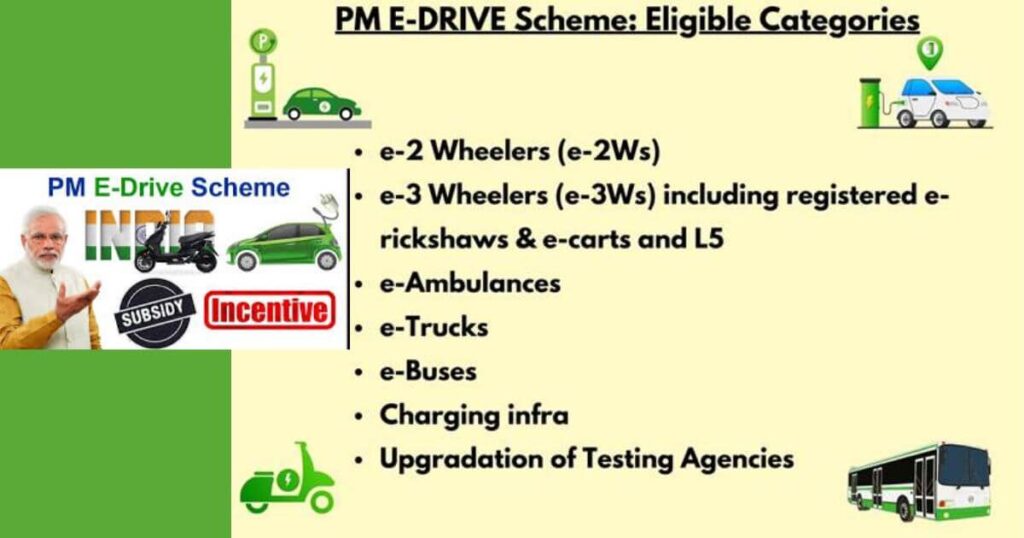

PM E-Drive Scheme:

The PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme is designed to boost green mobility and strengthen India’s electric vehicle ecosystem. The scheme has a budget of ₹10,900 crore for the period from 2024 to 2026.

Charging Infrastructure Investment:

As part of the PM E-Drive Scheme, the government is speeding up the expansion of EV charging facilities, setting aside ₹2,000 crore to install 72,000 charging stations across the country.

These stations will be placed in important locations like major cities, highways, airports, and industrial zones to make EV charging more accessible.

Bharat Heavy Electricals Limited (BHEL) has been appointed as the main agency to manage demand and develop a unified EV super app to support this initiative.

Additionally, over 7,000 public charging stations have already been approved under the FAME II scheme to help bridge the existing gap in charging infrastructure.

Also Read Sports Current Affairs 2025

E-Vehicle Policy (2024):

The central government has introduced a new policy in 2024 to position India as a hub for electric vehicle (EV) manufacturing. The policy requires a minimum investment of ₹4,150 crore, with no upper limit on investment.

Manufacturers are given three years to set up production facilities and begin commercial operations. They are also expected to achieve 50% local value addition within five years. To support this, the policy allows limited imports of EVs at reduced customs duties for companies that meet the investment conditions.

State-Level Actions:

States such as Telangana, Karnataka, and the Union Territory of Delhi (under the Switch Delhi campaign) are increasing their electric bus fleets in alignment with the PM E-DRIVE scheme.

These local efforts are helping drive the national move towards eco-friendly public transportation.

By combining central and state initiatives, the goal is to create a smooth EV ecosystem, promote green employment, and cut down on carbon emissions.

Government Incentives:

To encourage the use of electric vehicles, the government introduced major programs like the FAME II scheme, with a budget of ₹10,000 crore.

These initiatives have significantly helped increase the adoption of electric two-wheelers, three-wheelers, and buses across the country.

Also Read IIT Current Affairs 2025

Boosting Local Battery Production:

Under the Production Linked Incentive (PLI) scheme, the government has allocated ₹18,100 crore to support the manufacturing of Advanced Chemistry Cells (ACC) within India.

This move is aimed at reducing the country’s reliance on battery imports and cutting down the overall cost of EVs.

Policy Support for Domestic EV Manufacturing:

The Scheme to Promote Manufacturing of Electric Passenger Cars (SPMEPCI) offers lower import duties to attract international EV companies to set up manufacturing units in India.

This initiative is focused on strengthening local production, generating employment, and building a long-term, sustainable EV industry.

You May like Reading ICC CT 2025 Current affairs

Other Key Initiatives:

Electric Mobility Promotion Scheme:

This scheme encourages the use and production of electric vehicles by providing financial incentives.

Its main goals are to cut down carbon emissions, improve air quality, and support India’s move towards eco-friendly transportation.

Reduced GST on EVs and Charging Equipment:

To make EVs more affordable, the government has lowered the Goods and Services Tax (GST) on electric vehicles and charging devices to 5%.

This tax cut helps reduce the overall cost, encouraging more people to choose electric options.

PM e-Bus Sewa Scheme for Public Transport:

Launched by the Ministry of Housing and Urban Affairs, this scheme plans to introduce 10,000 electric buses under a public-private partnership (PPP) model.

The central government will provide financial support for infrastructure based on the size and type of state or city.

EV Mitra Scheme:

The EV Mitra Scheme makes it easier for EV users to access subsidies and promotes greater awareness about the advantages of switching to electric vehicles.

Electric Vehicle Manufacturers in India

Major Manufacturers

| Company | Vehicle Type | Key Focus / Offering |

|---|---|---|

| Tata Motors | 4W (Passenger & Fleet) | EVs with extended battery warranties and strong safety features |

| Mahindra Electric | 3W, 4W | Diverse EV lineup for both personal and commercial use |

| Ola Electric | 2W | Battery swapping services and popular e-scooters |

| Hero Electric | 2W | Wide range of affordable e-scooters |

| TVS Motor | 2W | Next-gen electric scooters with strong performance and service |

| Bajaj Auto | 2W | High-end design, strong branding, and R&D in EVs |

| MG Motor India | 4W | Advanced electric cars known for safety and features |

| Ather Energy | 2W | Premium e-scooters with proprietary fast-charging infrastructure |

Mid-Sized & Specialized EV Companies

| Company | Vehicle Type | Key Focus / Offering |

|---|---|---|

| Ampere Vehicles | 2W | Affordable EVs with reliable after-sales support |

| Okinawa Autotech | 2W | E-scooters across various price ranges |

| Revolt Motors | 2W | Smart electric motorcycles with subscription-based ownership |

| Simple Energy | 2W | High-performance scooters with modern features |

| Tork Motors | 2W | Stylish design and locally manufactured performance EVs |

| Ultraviolette Automotive | 2W | Tech-driven, high-speed electric bikes |

| Zypp Electric | 2W (Rental/Logistics) | Rental EV scooters focused on sustainable last-mile delivery |

| Euler Motors | 3W (Cargo) | Electric cargo vehicles for commercial logistics |

| Omega Seiki Mobility | 3W, Cargo | EVs built for delivery, logistics, and fleet solutions |

| MoEVing | Cargo / Platform | Works with logistics companies and OEMs to deploy EV fleets |

Battery & Technology-Driven Platforms

| Company | Vehicle Type | Key Focus / Offering |

|---|---|---|

| Battery Smart | Battery Swapping | Pan-India EV battery swapping network for multiple brands |

| Yulu | Micro-Mobility (2W) | AI + IoT-powered EV sharing and fleet management |

| Hop Electric | 2W | Budget-friendly electric scooters for everyday use |

| Pure EV | 2W | Focused on battery innovation and affordable EVs |

| Okaya EV | 2W | Durable and cost-effective e-scooters |

| Lohia Auto | 2W, 3W | Serving rural India with accessible electric mobility options |

| EVeium | 2W (Premium) | Offers luxury urban EV scooters with sustainable design |

Job areas in the EV sector

EV Design Engineers:

These professionals are at the core of EV development, focusing on designing essential components such as electric motors, battery systems, and powertrains. Their work directly influences vehicle performance, safety, and overall innovation. Typical initial level Salary Range in India : ₹5 to 8 lakh per year.

EV Powertrain Engineers:

Responsible for creating highly efficient powertrain systems, these engineers conduct detailed analysis and fine-tuning to ensure optimal energy conversion and smooth propulsion in electric vehicles. Typical initial level Salary aprroximately ₹7-15 lakh per year

Battery Management System (BMS) Engineers:

These specialists develop and oversee the Battery Management System—critical for maintaining battery health, enhancing safety, and ensuring reliable performance. Their role is vital in optimizing battery lifespan and stability. Typical initial level salary- ₹9-12 lakh per year

Charging Infrastructure Experts:

They plan, set up, and maintain electric vehicle charging networks. Their work is essential for ensuring accessibility, uptime, and seamless operation of public and private charging stations. Typical initial level salary- ₹5-14 lakh per year

Data Analysts & Software Developers:

These professionals gather and analyze data from EV systems to help improve vehicle efficiency and user experience. They also develop the software that powers features like energy monitoring, predictive maintenance, and smart driving systems. (Typical initial level salary- ₹3.5 to 8 lakh per year)

EV Service Technicians:

Skilled in both traditional automotive systems and modern EV technologies, these technicians diagnose and repair issues in electric vehicles, ensuring they remain road-ready and efficient. Typical initial level salary- ₹3 to 5 lakh per year

Also read AI current Affairs 2025

Excellent description❤️

Thank you 😊 stay connected